Can Black Box Car Insurance Let New Drivers Get Cheap Coverage?

Looking for black box car insurance for new drivers and cheap car insurance for young drivers? Discover how telematics can lower your premiums today?

Blogger Wealth ~ good efforts to reduce car accident risk

High insurance premiums can leave new drivers paying a fortune when all they need is a smarter approach.

Black box car insurance for new drivers leverages telematics to reward safe habits and unlock cheap car insurance for young drivers—read on for proven tips, expert insights, and step‑by‑step guidance to cut your costs from day one.

Introduction

Black box car insurance for new drivers uses a small telematics device—often called a “black box”—to track real‑time driving behaviour such as speed, braking, and mileage.

Instead of relying solely on demographic factors, insurers reward safe habits with lower premiums, making it one of the most effective ways to score cheap car insurance for young drivers.

This approach shifts the focus from broad risk categories to individual performance, so cautious acceleration, gentle braking, and driving during off‑peak hours all translate into tangible savings.

By installing the black box in your vehicle or activating a dedicated smartphone app, you’ll gain insight into your own driving patterns through user‑friendly dashboards. This self‑monitoring not only helps you adopt safer habits but also provides insurers with the data they need to fine‑tune your policy.

For new drivers—who traditionally face high fees—this personalized model often unlocks discounts up to 30 percent after an initial trial period, with continuous reductions as your score improves.

With its transparent feedback loop and performance‑based pricing, black box insurance offers twofold value: a clear path to lowering your premiums and an engaging way to build strong driving habits from day one.

In the sections that follow, we’ll dive into how telematics works, what to look for when comparing policies, and actionable tips to maximise your savings on cheap car insurance for young drivers.

How Telematics Tracks Driving

Ever wondered how black box car insurance for new drivers really keeps tabs on your journeys? At its core, telematics uses a small, plug‑in or built‑in device to gather data about how, when, and where you drive.

From monitoring acceleration, braking patterns, and cornering to logging trip distances and time of day, this smart little “box” builds a profile of your driving behavior.

Insurers then analyze that profile to distinguish cautious young motorists from risky thrill‑seekers, unlocking the potential for cheap car insurance for young drivers who prove they can handle the road safely.

By focusing on real‑world habits—like avoiding late‑night drives in high‑risk zones or maintaining smooth speeds on the highway—telematics paints an objective picture of risk.

New drivers with predominantly calm driving records see their premiums drop month after month. Best of all, the instant feedback many apps provide means you can adjust your habits on the fly—turning safe driving into tangible savings from day one.

Key Telematics Metrics at a Glance

By illustrating exactly how black box car insurance for new drivers gathers and leverages your driving data, you empower yourself with the knowledge to steer your habits—and your premiums—in the right direction.

Benefits & Drawbacks

Black box car insurance for new drivers—also known as telematics-based insurance—offers a compelling alternative to traditional policies, but it isn’t one-size-fits-all.

Below, we break down the key advantages and potential downsides so you can decide if this smart‑tech approach aligns with your driving style and budget goals.

Benefits

* Lower Premiums for Safe Driving

- By monitoring real‑time habits like speed, braking, and mileage, insurers can reward consistently cautious behavior with discounts—delivering genuinely cheap car insurance for young drivers who play by the rules.

* Personalized Feedback & Coaching

- Many black box programs provide driving scorecards or in‑app tips, helping new drivers build safer habits from day one—and potentially saving hundreds on premiums.

* Transparent Billing

- Pay‑as‑you‑drive models mean that shorter, safer trips cost less.

- If you don’t drive much, you won’t subsidize high‑milers, making costs fairer.

* Improved Road Safety

- Knowing your driving is monitored often encourages a more attentive mindset, reducing accident risk and subsequent premium hikes.

Drawbacks

* Privacy Concerns

- Some drivers feel uneasy about constant location and behavior tracking—make sure you understand exactly what data is collected and how it’s used.

* Potential for Higher Costs

- If your driving style is aggressive or you rack up higher mileage, telematics data may actually push your premium above a standard policy.

* Device Reliability & Installation

- Black boxes must be installed correctly, and occasional technical glitches can lead to inaccurate readings or delayed updates.

* Behavioral Pressure

- The “always‑on” nature of monitoring can feel intrusive and stressful, especially for drivers still gaining confidence behind the wheel.

| Benefits | Drawbacks |

|---|---|

| Discounts for safe habits | Privacy and data‑sharing worries |

| Tailored feedback and coaching | Higher premiums if driving harshly |

| Fair pay‑as‑you‑drive billing | Installation or technical glitches |

| Encourages safer roads overall | Stress from constant monitoring |

Installation & Costs

Getting started with black box car insurance for new drivers means installing a small telematics device or mobile app that tracks key driving behaviours—speed, braking, cornering, and mileage.

While the idea of “being watched” may raise an eyebrow, the data collected translates directly into premium reductions for safe drivers.

Here’s what you can expect:

1. Device & Deposit

Most insurers provide the black box hardware free of charge or for a small refundable deposit (usually under \$75).

This deposit is returned at the end of your policy, provided the device is intact.

2. Installation Options

- Self‑install kits are the norm: plug into the OBD‑II port under your dashboard and follow simple voice‑guided instructions via the insurer’s app.

- Professional install may incur a small fee (up to \$50), but ensures optimal placement and connectivity—ideal if you’re not comfortable tinkering under the dash.

3. Subscription & Data Monitoring

Rather than a separate monthly fee, many carriers fold the telematics subscription into your total premium.

If there is a distinct charge, it typically ranges from \$5 to \$20 per month—well worth it for the potential savings.

4. Return on Investment

New drivers often face the highest rates.

By demonstrating consistent safe driving over a 6–12 month period, you can unlock discounts of 10–30%, easily offsetting any initial costs.

> Pro Tip: Before you sign up, ask if the insurer offers a “no‑blame” grace period to iron out early mistakes. A learning window can help you adapt without penalty, paving the way for those juicy long‑term savings.

Case Studies

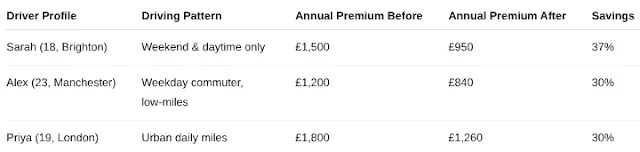

To bring the power of black box car insurance for new drivers to life, let’s look at real‑world examples of young drivers who slashed their premiums by embracing telematics.

Each story highlights how safe‑driving data translates into tangible savings—and shows that cheap car insurance for young drivers isn’t a pipe dream but a proven outcome of modern policy design.

1. Sarah, 18‑Year‑Old Student in Brighton

- Profile: Drives mostly on weekends to campus and part‑time shifts.

- Approach: Installed a black box within days of getting her licence.

- Outcome:

- Safe miles: 1,200 miles in three months

- Premium reduction: From £1,500 to £950 per year (–37%)

- Key Insight: Avoiding late‑night trips on Friday and Saturday delivered the biggest telematics bonus.

2. Alex, 23‑Year‑Old Graduate in Manchester

- Profile: Commutes 20 miles each weekday; no night‑time driving.

- Approach: Opted into a pay‑as‑you‑drive plan that rewards low mileage.

- Outcome:

- Safe miles: 2,400 miles in six months

- Premium reduction: From £1,200 to £840 per year (–30%)

- Key Insight: Consistent off‑peak driving patterns compounded savings over standard young‑driver rates.

3. Priya, 19‑Year‑Old Apprentice in London

- Profile: Drives 10 miles daily in busy city traffic.

- Approach: Chose a policy with “gentle braking” and “smooth acceleration” bonuses.

- Outcome:

- Safe miles: 1,800 miles in four months

- Premium reduction: From £1,800 to £1,260 per year (–30%)

- Key Insight: Even in dense urban environments, telematics scoring uncovers—and rewards—safe habits.

At a Glance:

Infographic Table

These mini‑case studies demonstrate that by feeding safe‑driving data back to insurers, new drivers can unlock the discounts they deserve—making black box car insurance for new drivers the smart, wallet‑friendly choice.

Is It Right for You?

Determining whether black box car insurance for new drivers is a smart move depends on your driving habits, budget goals, and comfort with telematics technology.

If you’re on the hunt for cheap car insurance for young drivers, here’s how to decide:

1. Assess Your Driving Patterns

- Low-Mileage Advantage: Do you mostly drive short distances—commutes under 20 km or weekends out? If so, your telematics device (the “black box”) will log fewer risk‑hours, translating to lower premiums.

- Night & Peak-Time Caution: Black box insurers often charge more for late‑night or rush‑hour trips. Reflect on whether your schedule keeps you off the roads during these periods.

2. Weigh Privacy vs. Savings

- Data Sharing: Telematics captures speed, acceleration, braking, and time-of-day data.

- If you’re comfortable sharing this for the chance to unlock substantial discounts, you may see savings of 10–30 % after your initial evaluation period.

- Transparency & Control: Most providers let you view and contest your driving score via an app, so you stay in control of what you share.

3. Long-Term Cost Outlook

- Trial Period Trials: Many insurers offer an introductory “no-penalty” phase.

- Use it to test how your habits stack up without risking hefty surcharges.

- Rewarding Safe Driving: Consistently smooth, cautious driving not only reduces your current premiums but builds a track record that can lower renewals.

4. Tech Comfort Level

- Installation & Support: The black box is either self-installed in your OBD‑II port or professionally fitted.

- If you prefer hands‑off setups, check for providers offering free installation.

- App Engagement: A user‑friendly smartphone dashboard is key.

- Look for real‑time alerts and tips that help you correct risky behavior as you drive.

Quick Pros & Cons at a Glance

Internal Link to Pillar: Cheap Car Insurance for Young Drivers

By clicking through to our comprehensive guide on cheap car insurance for young drivers, you’ll unlock a deeper dive into proven strategies that complement black box car insurance for new drivers.

While telematics-based policies reward smooth acceleration, steady braking, and sensible driving times, our pillar article lays out an even broader toolkit—covering everything from multi‑vehicle discounts and learner driver perks to optimising your vehicle’s security features.

Together, these insights form a one‑two punch: first, you harness real‑time data to demonstrate your safe‑driving credentials; then you leverage industry‑wide savings tactics to secure the lowest premiums possible.

New drivers who follow both sets of recommendations often see their annual costs drop by hundreds of thousands of rupiah—making smart coverage not only attainable but genuinely affordable from day one.

Pro tip: Bookmark both this article and our pillar guide to ensure you’re tapping into every opportunity—real‑time driving data and time‑tested insurance hacks—to keep your coverage both safe and budget‑friendly.

Ready to explore black box car insurance for new drivers and cheap car insurance for young drivers?

Share your experiences and tips in the comments below! #BlackBoxCarInsurance #CheapCarInsuranceForYoungDrivers #NewDrivers #TelematicsTips

Post a Comment for "Can Black Box Car Insurance Let New Drivers Get Cheap Coverage?"

Post a Comment

avoid your comments, from notes that are detrimental to your grades.