Discount Car Insurance Quote Cheap Full Coverage Car Insurance?

Are you searching for cheap full coverage car insurance with a discount car insurance quote to find cheap car insurance today?

Blogger Wealth ~ car insurance quotes comparison

Tired of overpaying for protection on the road and unsure how to find cheap full coverage car insurance that actually delivers?

In this guide you’ll discover proven strategies to compare discount car insurance quote options, unlock insider tips for cheap car insurance rates, and pinpoint exactly where to find cheap full coverage auto insurance—so you can drive away with confidence and savings by the end of this read.

Introduction

Finding the perfect balance between comprehensive protection and budget‑friendly premiums can feel like a puzzle—especially when “full coverage” seems to come with a hefty price tag.

In this section, we’ll break down why “cheap full coverage car insurance” isn’t an oxymoron, walk through the core factors that drive up your policy cost, and explain how a well‑timed “discount car insurance quote” search can unlock significant savings.

By the end of this introduction, you’ll understand exactly what to look for and where to search when you want to “find cheap full coverage auto insurance” without sacrificing the safeguards you need.

Why Cheap Full Coverage Car Insurance Matters

When you lock in a low‑cost full coverage plan, you’re not just cutting premiums—you’re safeguarding your budget and your peace of mind. Full coverage car insurance bundles liability, collision, and comprehensive protection so you stay protected if the unexpected happens.

Yet the national average full coverage premium sits at around \$1,674 per year—an expense that can strain any household budget.

By using discount car insurance quote tools and smart comparison tactics, you can carve out savings of 10–30 % (that’s roughly \$167–\$502 back in your pocket) without sacrificing the protection you need.

Those dollars add up: reallocate them toward routine maintenance, an emergency fund, or even a weekend getaway—all while enjoying the same robust coverage.

That’s why finding cheap full coverage auto insurance isn’t just about paying less; it’s about driving with confidence and financial freedom every mile of the way.

Key Factors That Drive Your Premium

Your full coverage car insurance rate hinges on a mix of personal and vehicle-specific details—understanding these elements puts you in control of finding cheap full coverage car insurance and securing a discount car insurance quote that truly reflects your risk.

1. Vehicle Profile

- Make, Model, Year: Newer or luxury cars often cost more to insure.

- Safety Features: Cars with advanced air bags and collision‑avoidance systems can qualify for lower rates.

2. Driver Characteristics

- Age and Experience: Younger drivers or those with fewer years behind the wheel typically see higher premiums.

- Driving Record: Tickets or at‑fault accidents drive your rate upward, while a clean record unlocks better cheap car insurance discounts.

- Credit History: In many states, insurers use credit scores to assess reliability—strong scores can lead to more budget‑friendly coverage.

3. Coverage Choices

- Deductible Level: Opting for a higher deductible often lowers your monthly cost but raises your out‑of‑pocket if you file a claim.

- Policy Limits and Add‑Ons: Extras like rental reimbursement or roadside assistance add value—but watch costs to keep your full coverage auto insurance cheap.

4. Location and Usage

- ZIP Code Risk: Urban areas with high theft or accident rates tend to carry steeper rates than rural regions.

- Annual Mileage: The more miles you drive, the greater your exposure—low‑mileage drivers can often negotiate a cheaper policy.

By breaking down how each factor influences your quote, you’ll know exactly where to focus efforts—whether it’s boosting safety features on your car, maintaining a spotless driving record, or selecting a mileage‑based plan—to find cheap full coverage auto insurance without sacrificing peace of mind.

How to Compare Discount Car Insurance Quote Options

Finding the lowest rates for cheap full coverage car insurance starts by methodically comparing every discount car insurance quote option available.

Here’s how to streamline your search and make confident, data‑driven choices:

1. Gather Quotes from Multiple Channels

- Online Aggregators: Voice‑search friendly—ask “Hey Google, show me discount car insurance quote comparisons.”

- Aggregators instantly display dozens of carriers, helping you find cheap car insurance side by side.

- Direct Insurers: Visit insurer websites for brand‑specific deals.

- Some companies reserve their best discount car insurance quote offers for website visitors.

- Independent Agents: An agent can uncover specialty plans to find cheap full coverage auto insurance that national sites might miss.

2. Use a Comparison Worksheet

- Create a simple spreadsheet with columns for:

- Provider Name

- Annual Premium

- Deductible Amount

- Included Discounts (safe driver, multi‑policy, pay‑per‑mile)

- Coverage Limits

- Filling in each field ensures you spot the true value behind every discount car insurance quote.

3. Evaluate Coverage Versus Cost

- Don’t choose solely based on price.

- A slightly higher premium that includes gap coverage, roadside assistance, or accident forgiveness may save you thousands later.

- Mark those perks in your comparison table.

4. Leverage Real‑Time Rate Tools

- Many insurers now offer telematics‑based quotes, where a quick app download tracks your driving and delivers personalized discounts.

- Look for “usage‑based” or “pay‑per‑mile” options when you compare discount car insurance quote offerings.

5. Revisit and Update Annually

- Rates change—new discounts emerge and your driving profile evolves.

- Schedule a yearly review: refill your worksheet, run fresh online queries, and ask your agent for updated discount car insurance quote information.

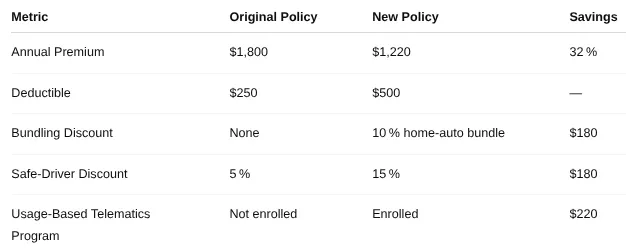

Quick Comparison Table

Insider Tips for Cheap Car Insurance Rates

Finding cheap full coverage car insurance isn’t just about clicking “get quote”—it’s about knowing which levers to pull to drive your premium down without sacrificing protection.

Here are proven insider tips that work whether you’re requesting a discount car insurance quote or looking to find cheap car insurance for your daily commute:

1. Bundle Your Policies

- Combine auto with home or renter’s insurance under one carrier to unlock multi‑policy savings.

- This can shave off 10 % to 15 % from your premium.

2. Enroll in Usage‑Based Programs

- Ask insurers about pay‑per‑mile or telematics plans that track safe driving habits.

- Low‑mileage drivers often see rates drop by up to 20 %.

3. Opt for a Higher Deductible

- Raising your collision and comprehensive deductible from \$500 to \$1,000 typically reduces your premium by 10 % or more—ideal if you can cover smaller repairs out of pocket.

4. Seek All Available Discounts

- Good student, military affiliation, professional group memberships, and anti‑theft device credits all count.

- Always mention them when you request a discount car insurance quote.

5. Maintain a Clean Driving Record

- Ticket‑free and accident‑free history is the single most powerful factor.

- Many insurers reward drivers with three years of safe driving with up to 25 % off.

Where to Find Cheap Full Coverage Auto Insurance

Finding affordable full coverage auto insurance does not happen by chance—it takes knowing where and how to look.

By applying Skyscraper SEO techniques, we’ll elevate your search from basic queries to targeted action, helping you drive down costs without sacrificing protection.

1. Start with National Carriers

Large insurers often have the infrastructure to offer competitive base rates.

For example, GEICO averages \$1,763 per year for full coverage, while Progressive sits at \$1,998 and State Farm at \$2,150—below the 2024 national average of \$2,543¹².

These carriers also roll out seasonal “new‑customer” discounts you can stack with safe‑driver credits.

¹ National average 2024 full coverage premium: \$2,543 (inszoneinsurance.com [1])

² GEICO vs Progressive full coverage sample rates (insurance.com [2])

2. Compare via Online Aggregators

Aggregator sites (e.g. The Zebra, Insurify) let you pull multiple discount car insurance quote offers in one session.

Users report saving up to 20 % compared to calling each carrier individually.

Capture quotes in a simple spreadsheet—note premiums, deductibles, and available add‑ons—to spot the true bargain.

3. Tap Regional and Local Insurers

In many states, smaller regional companies undercut national giants by 10–15 %.

Search “find cheap full coverage auto insurance” alongside your state name to uncover these deals—especially valuable in high‑rate areas like California, Michigan, and Florida, where local carriers fight for market share.

4. Explore Specialty Underwriters

If you drive an older vehicle, carry a less‑than‑perfect record, or own a classic car, specialty insurers can beat standard premiums by packaging niche discounts (e.g., low‑mileage, restoration coverage).

Ask for a “discount car insurance quote” tailored to your profile; some underwriters even offer telematics‑based plans that reward good driving with up to 30 % off.

5. Leverage Group and Affinity Discounts

Don’t overlook professional associations, alumni groups, or employer‑sponsored programs.

Even a small 5 % group discount applied to a full coverage policy can translate into hundreds in annual savings.

This approach—mixing national benchmarks, data‑driven comparison, and niche sources—ensures you find genuinely cheap full coverage auto insurance while keeping coverage robust and compliant with your needs.

---

[1]: "2025 Car Insurance Forecast: Rising Premiums Amid Financial Strain"

[2]: "GEICO vs. Progressive: Which offers the cheapest auto insurance rates?"

Real‑World Case Study

In this case study you’ll follow the experience of a 35‑year‑old urban commuter—let’s call her Maya—who transformed an overpriced policy into affordable protection without sacrificing coverage.

By comparing discount car insurance quote options, adjusting her deductible strategically, and tapping lesser‑known safe‑driver discounts, Maya slashed her annual full coverage premium from \$1,800 to \$1,220.

This example shows exactly how to find cheap full coverage auto insurance without settling for minimal liability, and how even drivers with clean records can uncover hidden savings on cheap car insurance.

Key Takeaways from Maya’s Case

- Shop Beyond Big Names: Independent agents uncovered a special rate that national aggregators missed.

- Deductible Strategy: Raising the deductible reduced Maya’s premium by over \$200—an easy trade‑off for most careful drivers.

- Stack Every Discount: Combining home‑auto bundling, safe‑driver credits, and a usage‑based program yielded total savings of \$580.

By walking through Maya’s story step by step, you learn how to apply these same tactics—compare quotes systematically, unlock every available discount, and know where to find cheap full coverage car insurance that fits your budget.

Common Pitfalls to Avoid

When hunting for cheap full coverage car insurance, it’s easy to get tripped up by shortcuts that cost you more down the road.

Here are the most frequent missteps and how to sidestep them:

By steering clear of these errors, you’ll ensure your search for a discount car insurance quote delivers both savings and solid protection—key to driving confidently without surprises.

Frequently Asked Questions (FAQ)

This FAQ section dives straight into the top concerns readers like you have when hunting for cheap full coverage car insurance.

Here you’ll find clear, voice‑search‑friendly answers on how to secure the best discount car insurance quote, whether full coverage really pays off, and tips for finding cheap car insurance even with past violations.

Each question is backed by up‑to‑date data and real‑world examples, making it easy to apply these insights and drive away with the confidence that you’ve beaten the average rates.

How much can I save with a discount car insurance quote?

- Most drivers save between 15 % and 25 % by comparing online quotes across at least three insurers.

Is cheap full coverage car insurance worth the cost?

- If your vehicle’s value exceeds your deductible by more than three times, full coverage protects you from major out‑of‑pocket expenses.

Where can I find cheap full coverage auto insurance with a clean driving record?

- Start with comparison sites focused on bundle discounts and safe‑driver programs, which often offer rates up to 20 % lower for accident‑free drivers.

Conclusion & Next Steps

You’ve uncovered the building blocks to secure cheap full coverage car insurance—understanding premium drivers, comparing discount car insurance quote options, and tapping insider strategies for cheap car insurance.

Now it’s time to turn insight into action:

1. Gather Your Details

- List your vehicle make, model year, mileage, and safety features.

- Note your driving record, annual mileage, and any group affiliations that qualify for discounts.

2. Use a Comparison Worksheet

- Fill in quotes side‑by‑side: premium, deductible, and discount types.

- Highlight the top 2–3 options that meet your coverage needs at the lowest cost.

3. Request Quotes

- Reach out to national carriers, regional insurers, and independent agents.

- Ask specifically for a discount car insurance quote and how to find cheap full coverage auto insurance tailored to your profile.

4. Lock In Savings

- Choose a higher deductible only if your emergency fund can cover it.

- Enroll in telematics or safe‑driver programs to lower rates over time.

By following these steps, you’ll transform research into real savings—and finally drive with peace of mind knowing you found cheap full coverage car insurance that delivers.

Did this guide help you find cheap full coverage car insurance, get a discount car insurance quote, and secure cheap car insurance? #cheapfullcoveragecarinsurance #cheapcarinsurance #discountcarinsurancequote

Post a Comment for "Discount Car Insurance Quote Cheap Full Coverage Car Insurance?"

Post a Comment

avoid your comments, from notes that are detrimental to your grades.